In Pakistan, thousands of young people are full of business ideas but lack the money to turn them into reality. To solve this issue, the government has continued the Prime Minister Youth Loan Scheme 2025. This program is a golden opportunity for young men and women who want to start a new business, expand an existing one, or invest in freelancing and agriculture projects. The scheme offers interest-free and low-interest loans, making it much easier for youth to take the first step toward self-employment and entrepreneurship.

This article explains everything in simple words: eligibility criteria, how to apply online, loan tiers, required documents, repayment details, and benefits. By the end, you’ll have a clear roadmap for applying successfully.

What is the Prime Minister Youth Loan Scheme?

The Youth Loan Scheme (PMYLS) is a government-financed initiative that provides subsidized loans through different commercial and Islamic banks. The aim is to reduce unemployment and create job opportunities by supporting youth-led businesses.

Main Objectives

- Promote self-employment and small businesses

- Support women and differently-abled individuals in economic activities

- Encourage innovative business ideas in IT, agriculture, and trade

- Create job opportunities in rural and urban areas.

How to Apply Online for PM Youth Loan Scheme 2025

The application process is straightforward and fully online:

- Visit the official portal: pmyp.gov.pk

- Click on “Apply Online” under the Youth Business Loan section

- Enter CNIC and personal details

- Upload required documents along with a simple business plan

- Select your preferred bank from the available list

- Submit the application and save the tracking number

- Wait for confirmation via SMS or email from the bank.

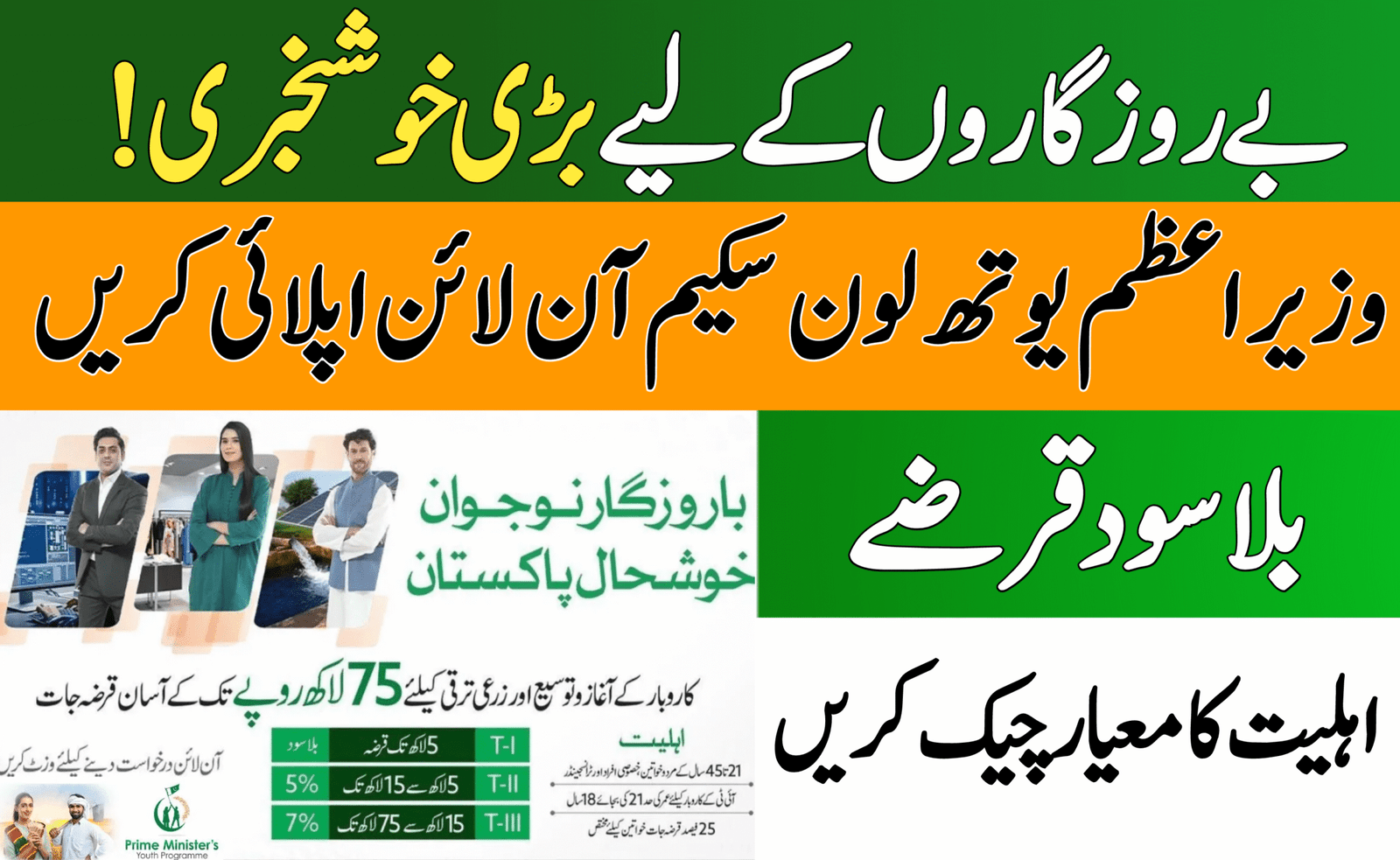

Eligibility Criteria for PM Youth Loan Scheme

To apply for the scheme, you must:

- Be a Pakistani citizen with a valid CNIC

- Be between 21 to 45 years old (18 years for IT/e-commerce)

- Have a workable business idea or plan

- Women, disabled individuals, and rural youth are strongly encouraged.

PM Youth Loan Tiers and Repayment

| Tier | Loan Amount | Customer Markup Rate | Repayment Tenure |

| T1 | PKR 100,000 – 1 million | 0% (interest-free) | Up to 3 years |

| T2 | Above 1 million – 5 million | 5% | Up to 5 years |

| T3 | Above 5 million – 7.5 million | 7% | Up to 7 years |

Required Documents for PM Youth Loan Scheme

| Requirement | Status |

| Valid CNIC | ✔ |

| Mobile SIM registered in your name | ✔ |

| Passport-size photograph | ✔ |

| Educational certificate (if applicable) | ✔ |

| Business plan or proposal | ✔ |

| Bank account details | ✔ |

| Utility bill (for address verification) | ✔ |

PM Youth Loan Participating Banks

You can choose from several participating banks, including:

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Meezan Bank Limited

- United Bank Limited (UBL)

- Habib Bank Limited (HBL)

- Allied Bank Limited (ABL)

- Zarai Taraqiati Bank (ZTBL)

- First Women Bank Limited (FWBL)

How Freelancers Can Benefit

Freelancers are one of the biggest winners of this scheme. With small loans, they can buy laptops, set up home offices, and invest in better internet and software. This allows them to move from part-time gigs to sustainable digital careers, earning in dollars through platforms like Fiverr and Upwork.

Why a Business Plan Matters

Banks still want to see how you plan to use the loan. A clear business plan showing expenses, income, and repayment methods makes approval much easier. For example, a dairy farmer should outline the number of animals to be purchased and expected milk sales. A freelancer should explain how better tools will increase their earnings.

Benefits of PM Youth Loan Scheme

- Interest-free and low markup financing options

- Encourages entrepreneurship instead of job seeking

- Special quota for women entrepreneurs

- Easy repayment period of up to 7 years

- Supports traders, farmers, and IT professionals equally.

Conclusion

The PM Youth Loan Scheme 2025 is more than just a loan program; it is a lifeline for Pakistan’s young entrepreneurs. With easy online applications, interest-free tiers, and flexible repayment plans, it gives youth the power to turn dreams into reality. Whether you are a freelancer, farmer, or small business owner, this scheme can open doors to financial independence and stability.

FAQs

Q1: What is the maximum loan amount?

Up to PKR 7.5 million under Tier 3.

Q2: Can women apply?

Yes, there are dedicated quotas for women.

Q3: Is collateral required for Tier 1?

No, Tier 1 loans are interest-free and collateral-free.

Q4: Can freelancers apply?

Yes, freelancers and IT professionals above 18 years can apply.

Q5: How long does approval take?

Usually a few weeks, depending on bank verification.